Government Grants

Business Grants

Home Owner Programs

Federal Programs

About Us

Grant and Loans for Women-Owned Small Businesses

One of the cornerstones of a healthy community is a vibrant and diverse small business sector. The federal and state governments offer a variety of programs and support for women owned small businesses.

Use these resources to help to start of expand your business

Learn More about SBA Women's Business Centers see here

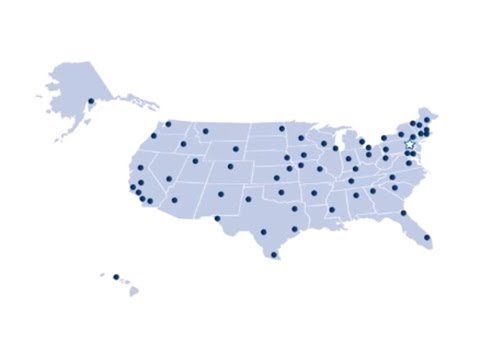

Women's Business Centers (WBCs) stand for a nationwide network of nearly 100 instructional centers throughout the United States and its territories, which are created to help women in beginning and growing small companies. WBCs seek to "level the playing field" for women entrepreneurs, who still face unique obstacles in business world.

SBA's Office of Women's Business Ownership (OWBO) oversees the WBC network, which provides entrepreneurs (specifically women who are economically or socially disadvantaged) comprehensive training and counseling on a range of topics in numerous languages.

Many of the SBA programs offering Small Business Grants, Loan Programs and Counseling Programs for women are offered through universities and centers.

Small Business Administration Loan Guarantees Program

The Small Business Administration has established the Loan Guarantees Program wherein they aim to be able to provide guaranteed loans to small business establishments which are not capable of acquiring financing from a private credit marketplace but greatly manifests the ability to repay funds in a timely manner.

SBA Portable Assistance Program

The Portable Assistance Program seeks to provide grants to Small Business Development Lead Centers that provide services to small businesses in an effort to increase the success of small business establishments and their viability in certain communities where economic hardship is apparent and is attributable to the impact of a major disaster.

How The Government Can Help Your Small Business

The Small Business Administration is largely responsible for providing indirect financial assistance to entrepreneurs and small business establishments. In most cases, the primary role of the SBA is to provide several financial assistance program to small business that have been specially designed to meet essential financing needs.

Featured Government Grant Resources

What Are Opportunity Zones

Opportunity Zones are an economic development tool that allows people to invest in distressed areas in the United States.

Minority Business Enterprise Centers for Minority-Owned Businesses

The The Minority Business Development Agency has recently constituted the Minority Business Enterprise Centers (MBEC) Program wherein it aims to support minority-owned businesses by providing them with electronic and one-on-one business development services for a reasonably nominal fee.

Social Entrepreneurship

Spotlight

When it Comes to Social Enterprises, Failure is the Best Platform for Innovation

In the world of social enterprises, failure is a cringe-worthy moment nobody wants to talk about. But, social entrepreneurs can benefit from their failures.